When speed matters more than perfection

How a risk-based consent model helped one legal team amend 96 contracts under pressure.

👋 Hey there, I’m Hadassah. Each month, I unpack how in-house legal teams use AI to enable their business, protect against risk, and free up time for the work they enjoy most—what works, what doesn’t, and the quick wins that make all the difference.

Before we dive in, a quick note: this is just one example of a legal team solving an operational bottleneck. There are plenty of ways to approach these kinds of problems, and the right solution will always depend on your specific needs and context. My goal is to give you some food for thought as you define what that solution should be.

Problem

For this user story, I’m joined by the Head of Legal at an early-stage fintech startup. When their banking partner abruptly exited the escrow market, their small legal team had just about eight weeks to amend 96 live escrow agreements and the linked customer funds to a new bank. Because each contract explicitly named the departing provider, they needed to find a way to get consent fast and push through variations to prevent business disruption.

The real challenge for this team wasn’t legal complexity, it was operational capacity. With no CLM system in place and contracts buried as static PDFs in SharePoint, identifying affected agreements, extracting key clauses, and issuing variations would require weeks of manual work. Hiring temporary support was possible but slow and expensive: roughly 40 weeks of effort and more than £25,000, well beyond the team’s available time and budget.

Solution

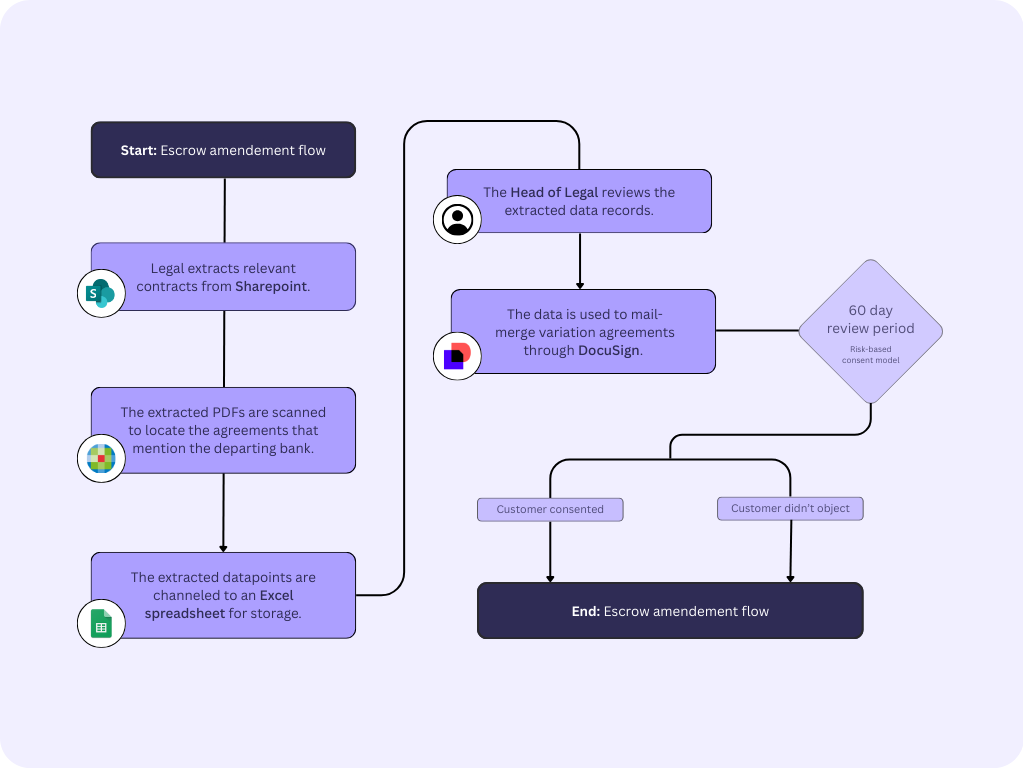

Faced with executive pressure and an immovable deadline, the team built a lightweight workflow using tools they were familiar with and trusted:

Microsoft Sharepoint;

Legisway Analyzer (previously: Della AI);

Microsoft Excel; and

This not only meant they could rely on their existing know-how, but it also avoided the need for development support or custom—and often costly—integrations.

With the chosen tools in place, the team first pulled all escrow agreements from Sharepoint. Because the team lacked a CLM system, they still had to manually sift through the SharePoint directory to identify which files were "escrow trust" agreements versus "escrow agent" agreements. Next, they used Legisway Analyzer to locate the agreements that mentioned the departing bank and extract key data (e.g. counterparty names and addresses) from each of them. The captured details were directly channelled into an Excel sheet. In just two days, they had a complete, structured view of all 96 affected contracts.

After the Head of Legal verified the dataset manually for accuracy, the team used it to mail-merge variation agreements through DocuSign, sending each customer a personalised email with a set of FAQs for clarification and a secure signing link to complete the process. To balance speed and risk, they adopted a pragmatic risk-based consent model: customers who didn’t object within 60 days were deemed to have consented based on the assumption that there was no pushback.

Results

All 96 escrow agreements were amended and completed within the tight timeframe, avoiding painful business disruption.

75% of the involved customers provided explicit consent to execute the new agreements, while consent of the remaining 25% was implied through the risk-based consent model.

Using off-the-shelf tools, the team built and relied on a workflow that cost £5,500, compared to an estimated £25,000 for manual review.

By leveraging automated contract analysis and data extraction tooling, the team was able to reduce an originally estimated timeframe of 40 weeks to 48 hours total.

Process

But getting buy-in to use a machine-learning tool wasn’t an easy sell. In early 2023—before genAI gained mainstream credibility—there was skepticism within the company about the added value of using AI to streamline operational processes, especially with a £5,500 price tag and no guaranteed payoff. At the time, IT couldn’t help either; they were fully committed elsewhere, so the solution had to rely entirely on off-the-shelf tools with no custom development.

It was pure urgency that ultimately cut through the resistance. With only about eight weeks to move client funds and no viable alternative, stakeholders backed a plan built around four requirements:

speed;

cost-effectiveness;

low manual input; and

operational trust.

Legisway Analyzer reduced weeks of review to two days; the workflow ran largely on autopilot; the Head of Legal verified the full dataset in under two hours; and cross-functional transparency—especially with Compliance, Customer Operations, and the CEO—built confidence in the approach.

In the end, the project became more than a crisis fix. It proved that clear communication, basic tooling, and tight alignment can deliver business-critical results under pressure. Though they didn’t capitalise on it immediately, the team later realised how important this success was and how it could have helped them to secure long-term investment to build a central, searchable contracting infrastructure and dataset.

Quick Wins

What made this work wasn’t just a shiny new piece of tech. It was the way the team approached the problem as well as the messy middle—moving quickly with what they had, keeping stakeholders close, and focusing on progress over perfection. Getting a new workflow off the ground is rarely about one big moment of success. More often, it’s about the small, practical wins that build momentum and keep a project moving forward.

For this legal team, those wins looked like:

Leveraging off-the-shelf tools. With no internal development capacity available, the team leveraged Legisway Analyzer to review and extract key contract data. This not only accelerated the project timeline but also proved that AI could offer an effective solution to overcome operational challenges.

Personalised outreach at scale. Mail merge paired with DocuSign enabled rapid, individualised agreement distribution without added headcount.

Risk-based fallback. By treating non-responses as implied consent after a set period of time, the legal team achieved 100% coverage with minimal follow-up.

Lean execution mindset. Rather than chasing perfection, the legal team focused on moving quickly once a plan was in place, working iteratively and adjusting as needed. This bias toward action helped them maintain momentum and deliver results without getting bogged down in unnecessary complexity.

Now it’s your turn. If your team is dealing with something similar, I hope this story sparks a few practical ideas you can put to work.

And… if you’ve been through something similar—or solved a different operational challenge altogether—I’d love to hear your story and spotlight your win.